Financial Information 2022

Piper Trust Annual Financial Report and Grants Compendium: Fiscal Year Ending March 2022

January 2023

Message from Carey Chambers, CFO

Dear Friends and Colleagues,

Virginia G. Piper Charitable Trust is pleased to provide its financials and grantmaking compendium for fiscal year ending March 2022. On September 13, 2021, Piper Trust announced its Now is the Moment grants initiative, awarding $123 million (its endowment earnings during the first 15 months of the COVID-19 pandemic) in surprise grants to 71 nonprofits in Maricopa County, Arizona. The Trustees were compelled to share all the endowment’s earnings with the community in one swift action and felt that Virginia Piper would have done so herself.

Piper Trust’s asset allocation remains diversified, providing resilience in recent difficult economic environments and should provide adequate returns in more favorable conditions. As always, and particularly considering the volatile stock market this past year, we are grateful for the expertise and assistance provided by Cambridge Associates, the Trust’s investment consultants and our dedicated Investment Committee members: Trustees Steve Zabilski (Investment Committee Chair), Jim Bruner, and Paul Critchfield, along with outside members Dr. Jeffrey Coles, Jacque Millard, and Kent Misener. The Investment Committee diligently evaluated Cambridge’s recommendations and reports, ensuring that investment managers continue to perform in accordance with their mandates, and operate effectively and in accordance with the law. We are also grateful for the dedication of the Trust’s Audit Committee members: Trustees Paul Critchfield (Audit Committee Chair), Jim Bruner, and Steve Zabilski, and outside member Frank Brady. We appreciate the audit services and expertise we receive from Crowe LLP. Our audit resulted in a clean opinion and no audit adjustments.

Carey Chambers, CFO

Virginia G. Piper Charitable Trust

Financial Results

Results of operations as reported in our audited financial statements are summarized in the following table. The data is presented on a GAAP, therefore accrual, basis. On a cash basis during the fiscal year ended March 31, 2022, grants and direct charitable activities were more than $163 million, and totaled $213 million over the two-year period. Each year operating and grantmaking expenses were in line with the budget approved by the board.

| (Accrual Basis) | 3/31/2022 | 3/31/2021 |

|---|---|---|

| Investment Activity, Net | 56,043,461 | 182,507,287 |

| Grant Awards and Direct Charitable Activities | (156,581,201) | (37,440,869) |

| Grantmaking and Administrative Expenses | (5,314,074) | (5,206,867) |

| Federal Excise Tax Benefit (Expense) on Net Investment Income | (797,350) | (1,883,706) |

| Contributions Received | – | 5,000 |

| Total Change | 106,649,164 | 137,980,845 |

| (Accrual Basis) | FY2022 | FY2021 |

|---|---|---|

| Beginning Net Assets | $573,777,873 | $435,797,028 |

| Ending Net Assets | $467,128,709 | $573,777,873 |

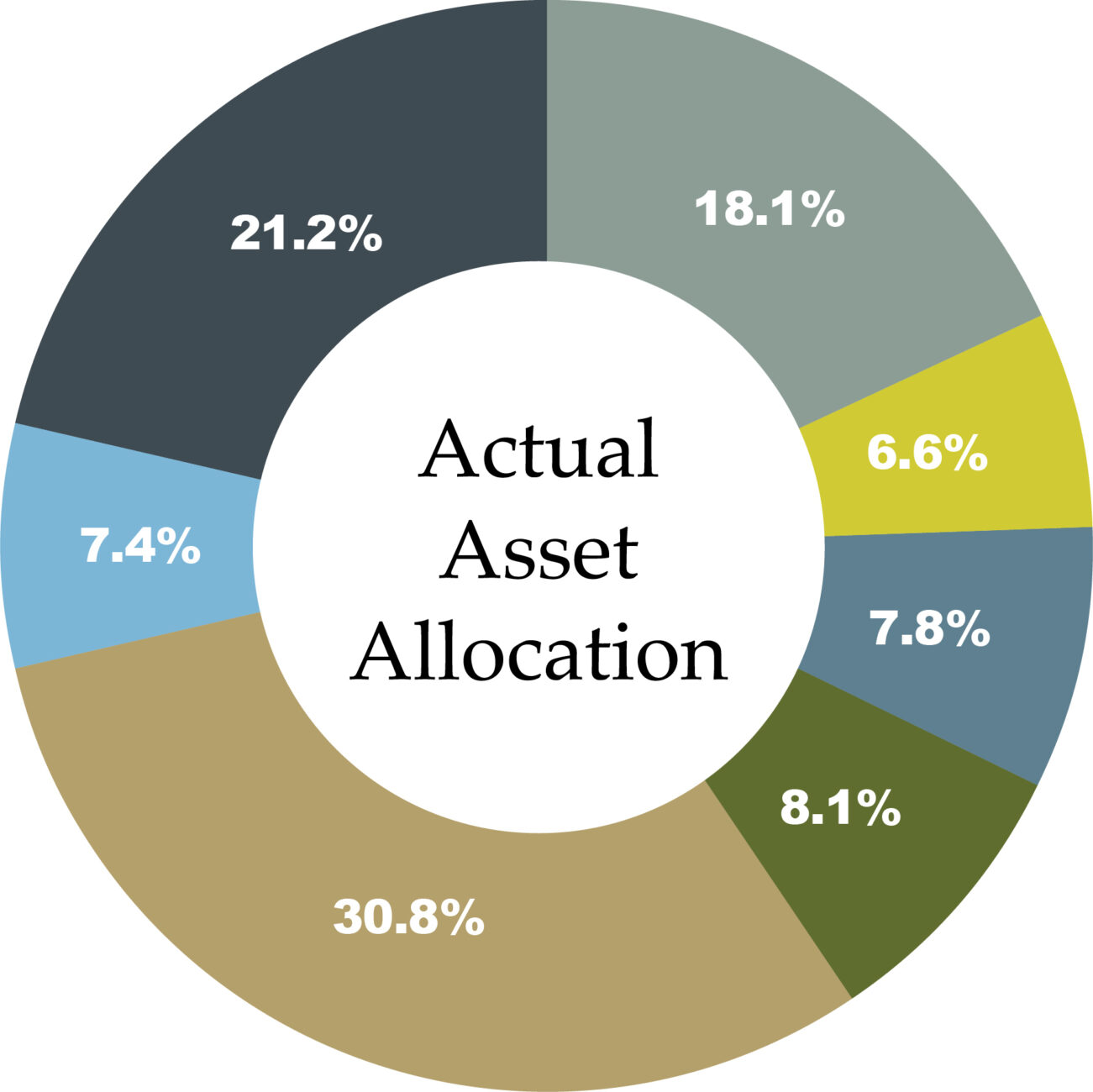

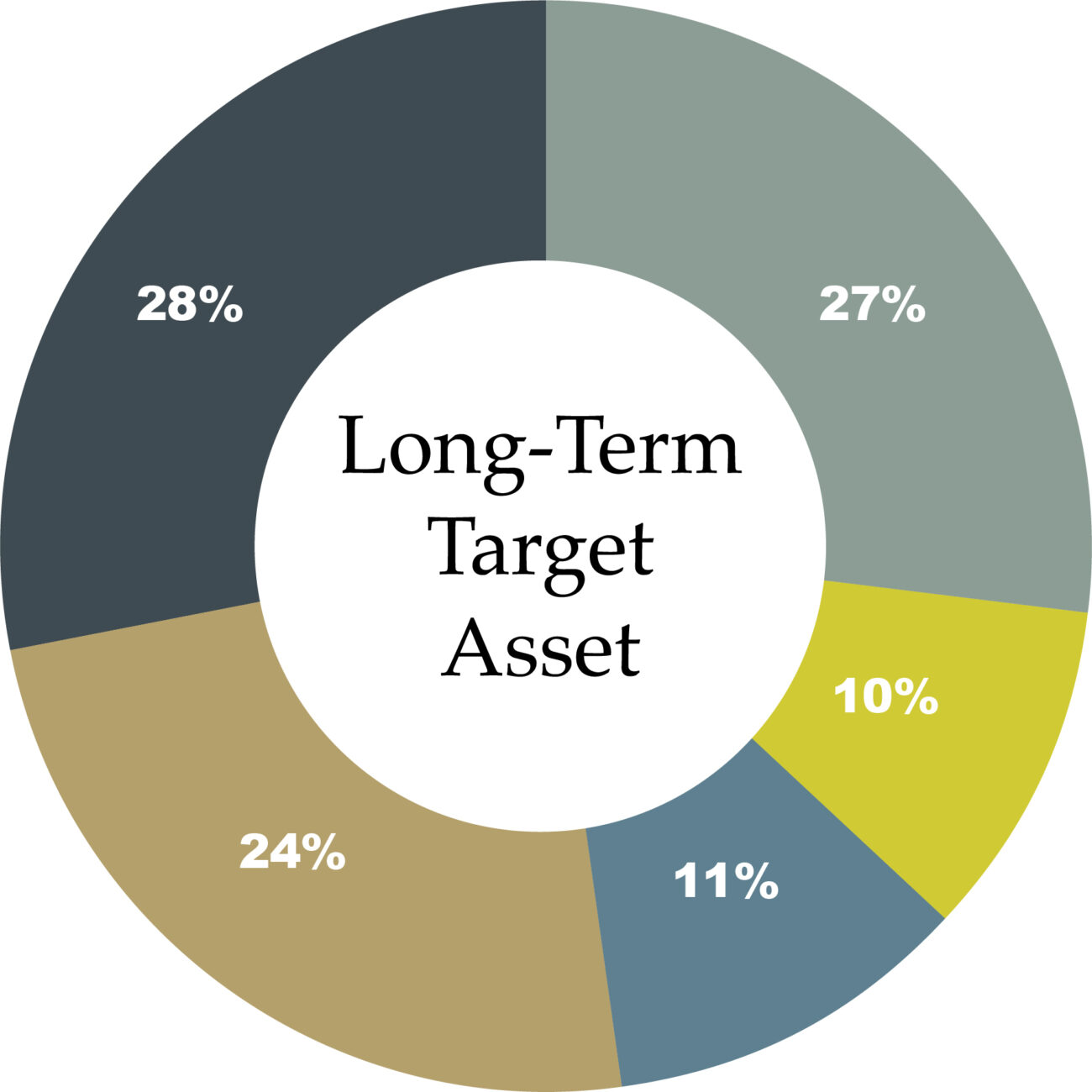

Asset Allocation

Under the guidance of the investment committee, the Trust’s endowment was invested in a diversified portfolio expected, in the long term, to generate returns to adequately support its mission. Actual and target allocations are reflected on the following charts.

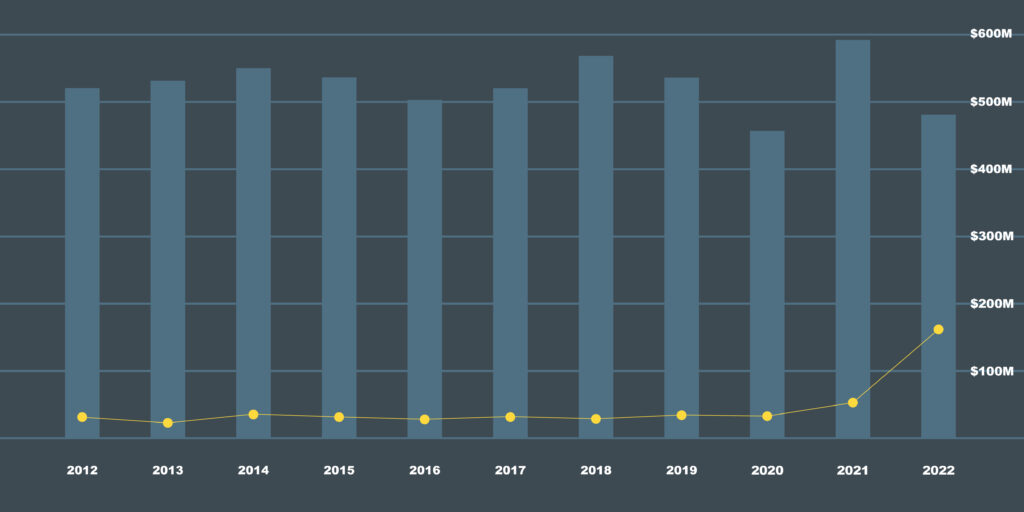

Fair Market Value of Investments and Charitable Expenditures

The blue bars illustrate the fair market value of Piper Trust’s investments and the yellow circles show the level of charitable expenditures each fiscal year.