Financial Report 2017-2018

Piper Trust Financial Report and Grants Compendium: Fiscal Years Ending March 2017 & 2018

July 2019

Message from Carey Chambers, CFO

Dear Friends and Colleagues,

Virginia G. Piper Charitable Trust is pleased to provide its financials and grantmaking compendium—via this compact biennial report format—for fiscal years ending March 2017 and March 2018. Piper Trust’s target asset allocation remains diversified, which should provide resilience in difficult economic environments and adequate returns in more favorable conditions. We continue to be grateful for the expertise and assistance provided by Cambridge Associates, the Trust’s investment consultants. The investment committee diligently evaluated Cambridge’s recommendations, and reports, ensuring that investment managers continue to perform in accordance with their mandates, operate effectively, and in accordance with the law. We truly appreciate our dedicated investment committee members: Trustees Jim Bruner, chair, Paul Critchfield, Art DeCabooter, and Steve Zabilski along with outside members Dr. Jeffrey Coles, Jacque Millard, and Kent Misener.

We are also grateful for the dedication of each audit committee member: Trustees Paul Critchfield, chair, Jim Bruner, Art DeCabooter, and Steve Zabilski, and outside member Frank Brady. Among many things, the audit committee initiated and has led oversight of the Trust’s managed security protocol over the past several years, which is designed to strengthen the organization’s information technology (IT) security posture.

Carey Chambers, CFO

Virginia G. Piper Charitable Trust

Financial Results

Results of operations as reported in our audited financial statements are summarized in the following table. The data is presented on a GAAP, therefore accrual, basis. On a cash basis during the fiscal year ended March 31, 2018, grants and direct charitable activities were more than $24.8 million, and totaled $74.5 million over the three-year period. Each year operating and grantmaking expenses were in line with the budget approved by the board.

| (Accrual Basis) | 3/31/2018 | 3/31/2017 |

|---|---|---|

| Investment Activity, Net | 59,223,028 | 55,393,785 |

| Grant Awards and Direct Charitable Activities | (14,033,349) | (25,560,232) |

| Grantmaking and Administrative Expenses | (4,923,077) | (4,903,467) |

| Federal Excise Tax Benefit (Expense) on Net Investment Income | (1,205,018) | (1,224,300) |

| Contributions Received | 100 | – |

| Total Change | $39,061,684 | $23,705,786 |

| (Accrual Basis) | FY2018 | FY2017 |

|---|---|---|

| Beginning Net Assets | $522,886,928 | $499,181,142 |

| Ending Net Assets | $561,948,612 | $522,886,928 |

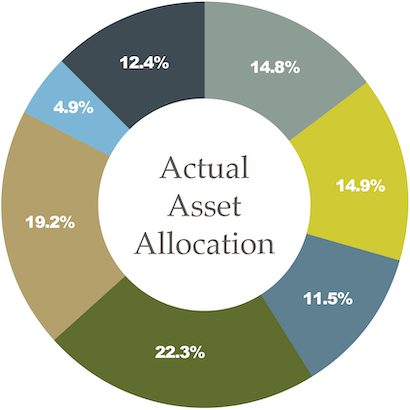

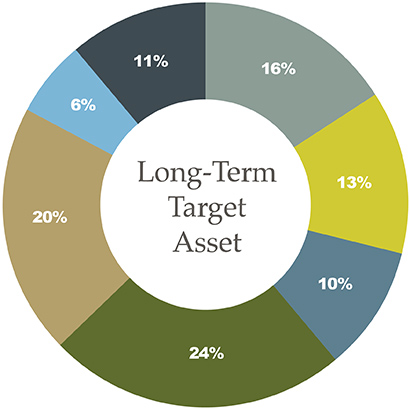

Asset Allocation

Under the guidance of the investment committee, the Trust’s endowment was invested in a diversified portfolio expected, in the long term, to generate returns to adequately support its mission. Actual and target allocations are reflected on the following charts.

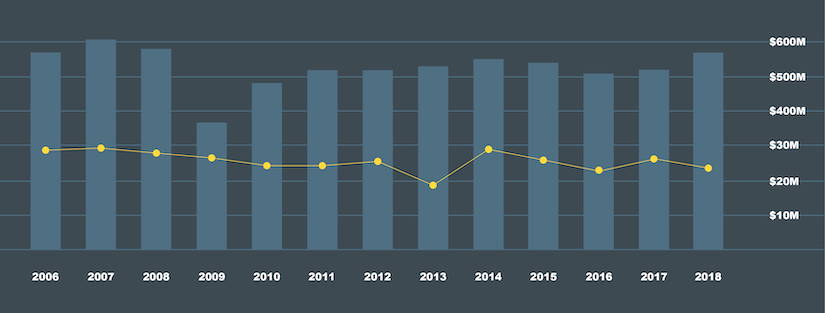

Fair Market Value of Investments and Charitable Expenditures

The blue bars illustrate the fair market value of Piper Trust’s investments and the yellow circles show the level of charitable expenditures each fiscal year.